Removing the Middleman, Part 2: Music

" 'The major labels want to say the glass is half full,' says Gwen Stefani's manager Jim Guerinot. 'I think everybody's getting the message: You better get a f***ing smaller glass. The music business is a different game.' "

--Rolling Stone Magazine, January 13 2006

Most people agree that the Internet and technology changes will make it possible to replace the pipe companies – the carriers, publishers, and networks that deliver the world's information, entertainment, and communication. But that change has been predicted for years. Will it really happen? If so, when? And what business and technology infrastructure needs to be created first?

In Part One, I gave an overview of the situation. This time let's look in depth at the music industry. I'll start with a summary and then explain how I got there.

Summary: E-music changes the world in unexpected ways

--I think the biggest change happening in music distribution right now isn't piracy, it's cannibalization of CD albums by e-music singles.

--I can't believe I'm saying this, but despite all the hype, the iTunes music store is actually much more powerful than most people realize. I think it may already be too late for any competitor to stop iTunes from becoming the dominant music store in the US.

--The tipping point at which the record companies will become obsolete may arrive in about two years.

--The record companies think that variable pricing for an online single will increase their profits, but the main effect will actually be to bring the tipping point closer.

I thought this was going to be an easy post to write, but I was wrong. Every time I thought I was finished, I found major new pieces of information that forced me to go back and re-write. The situation's complicated enough that I'm still not sure I got everything right. So I'll be very interested in your comments. Before we talk about where the industry's going, we need to discuss where it is now...

The music industry today

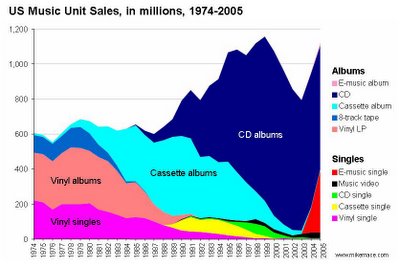

It's surprisingly hard to get clear data on what's happening in the music industry. Conditions are changing quickly, and the industry has some interesting counting practices that can easily confuse you unless you look at them very carefully. Below is the best chart I could create of music sales in the US (sorry, I couldn't find complete worldwide data). The chart shows US music unit sales by media type, from 1974 to 2005.*

Note that the chart shows unit sales, not revenue. Unit sales are a tricky thing in music – a single and an album each count as one unit. I used units because I couldn't find revenue numbers going back more than a few years. There are pluses and minuses to the units approach, which I'll discuss below.

The most striking thing you can see in the chart is the death and rebirth of the single. In 1974, singles were about a third of music unit sales, but by 2003 that share had dwindled to about 4%. That means music revenue grew much faster in the 1980s and 1990s than what you see in the chart, because customers moved from singles to more expensive albums.

Singles in a music store are a terrible buy today – a typical single on Amazon.com costs about $7-$10, and an album costs about $14. You might as well buy the album. And sure enough, most people do; about 97% of unit sales through retail are albums. The situation is reversed for e-music. On iTunes, a single costs 99 cents and an album costs about $10. Guess what, about 90% of iTunes unit sales are singles.

The big red triangle at the lower right-hand edge of the chart shows the impact of that online pricing structure. The triangle represents unit sales of e-music singles, primarily iTunes (Apple has about 70% to 83% of the US music download market, depending on which source you believe). iTunes and other online paid downloads raised the share of singles to about 25% of US unit sales in 2005, or about 353 million singles.

You can't see this in the chart, but revenue is not growing nearly as fast as units, because online singles are so much cheaper than CD albums. Rolling Stone even called 2005 the music industry's "worst ever." I guess they were thinking about musicians and record companies; music consumers had a fantastic year.

Are e-music sales still growing? A deeply pessimistic article by Bloomberg in November 2005 claimed that iTunes sales stopped growing in the summer of 2005. That drove a lot of pessimistic discussion in music industry circles, and let to a lot of criticism of Apple. If e-music has stopped growing, that would have very enormous implications for the industry, so I tried to figure out what's really happening.

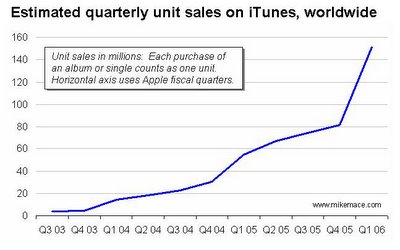

Apple doesn't give clear, regular reports on iTunes music sales. It occasionally issues a press release when it hits a milestone (100m songs sold, etc), and in its quarterly financials it reports a revenue figure for the iTunes store. But that number includes revenue from sales of iPod accessories, which are pretty large. You have to find a way to remove the accessory numbers. Here's what how I did that:

In Apple's fiscal first quarter of 2006 (the three months ending December 2005), it reported iTunes revenue of $491 million. Steve Jobs said at Macworld that the company was selling three million songs a day. That would produce revenue of about $273 million. So the iTunes revenue figure that Apple reports is about 56% songs and 44% accessories.

I went to Apple's previous financial reports, extracted the iTunes revenue numbers, and applied the 56% figure to them. The resulting estimate of iTunes unit sales matched up nicely with Apple's press releases on song sales, so I'm confident that the chart you see below is roughly accurate:

As you can see, Bloomberg was spectacularly wrong -- iTunes unit sales continue to grow quickly. Why did Bloomberg get it wrong? I suspect they made the mistake of looking at quarter to quarter numbers during the summer, when consumer electronics sales almost always stagnate. Sales then explode over the Christmas period. In consumer electronics, you always have to look at year over year comparisons, not quarter to quarter.

iTunes: The Creature that Ate Motown. Setting aside the growth rate, the raw numbers themselves are pretty astounding to me. iTunes alone probably accounts for about one in every five music purchases in the United States right now, and it's continuing to grow.

I think the impact of iTunes has been understated by analysts and the press. In November of 2005, NPD issued a report saying that iTunes had jumped into the top ten US music resellers, at number seven (above Tower Records and below Circuit City). But to calculate its figures, NPD divided iTunes' unit sales by 12, to account for the fact that most iTunes sales are singles. That's appropriate if you're looking at revenue, but I think the total number of transactions is still very meaningful – it speaks to the general amount of business you're driving, and the number of people you're touching.

Think about it: if NPD had counted transactions, iTunes would have tied with Wal-Mart (20% of US music sales) as the largest music store in the United States. Considering its current growth rate, iTunes is certain to become the largest unit seller of music in the US in 2006.

People talk about iTunes as if it's an early stage business, and they discuss all the rival e-music stores as if they're all on the same level as Apple. I'm starting to think that the real question is whether iTunes has already reached a position of unassailable dominance in e-music. I don't know if anyone else in the US can develop enough momentum fast enough to overcome what Apple's doing.

There are hints that Microsoft might try, though. A recent BusinessWeek article reports that Microsoft is considering building an iPod competitor, although the hints in the article make it sound more like a PSP wannabe. Microsoft has enough financial muscle to challenge Apple, but I don't know if it has the system design skills. Maybe it knows enough, though -- all it has to do is imitate Apple, and Microsoft certainly knows how to do that...

Why did CD sales drop after 2000? There's another important point to notice in the chart. Check out the decline in total music unit sales from 2000 to 2003. This is what has the music industry so concerned about Internet piracy, which some people assume is the cause of the decline. Because albums cost more than singles, the decline actually had a larger impact on industry revenue than the chart shows. Personally, I'm sure file sharing is part of the cause. But there are a lot of other explanations as well:

--The Economist claims an internal study conducted by one of the major record companies found that only 1/3 of the drop was attributable to online piracy, with much of the blame instead going to piracy of CDs and especially to the failure of the music companies to promote interesting new music.

--A study by professors at Harvard and the University of North Carolina could find no correlation between online music downloads and reduced sales of CDs. Other studies did find a correlation. This is one of those cases where you can pick the data that matches your preconceptions.

--Some interesting charts here and here argue that the economic downturn in 2001 and rising album prices may have been at fault. The author also points out that record companies dramatically cut their new music releases in the years that sales declined. I'm not sure whether that was a cause or an effect of the sales drop, but at minimum it probably steepened the decline.

--Even some record industry execs say the decline is due in part to rising competition from other forms of entertainment, like DVDs and video games.

Whatever the cause of the album sales slowdown in the past, I think what's happening today is crystal clear: Online singles are replacing CD albums. Unless you're dying to get a full album or you're a stickler for sound quality, there's a huge financial penalty for buying music on a CD today. As that fact sinks into the minds of consumers, music downloads are almost certain to continue to grow.

Welcome to the rabbit hole, Alice

That was the straightforward part of the post. Now things get tricky. Even with the growth of e-music, the record companies are still in charge today. Most musicians are still selling through music publishers whe keep most of the revenue; the artists and record companies are just splitting a smaller pie. I wanted to calculate the tipping point, the point at which it's more profitable for a musician to sell directly through iTunes and other online stores rather than going through a record company. Bear with me while a poli sci major tries to do math...

First, let's look at the economics of music today. If you record a hit song, you'll get less than 15% of the money that people pay to buy it. Maybe you'll get less than 2%. The New York Daily News did a nice case study of what happens to the money when a group creates an album that goes gold. Their fictional rock group, Grunthead, produces a record that brings in $8.49 million. The record company and distribution channels take about 85% of that off the top, and give 15% to the group. But then there are additional charges to produce the album, plus legal and agent fees. These reduce the band members' income to just $161,909 – 1.9% of revenue.

By the way, this assumes the band wrote all its own songs. If the songs were composed by someone else, the musicians would end up roughly splitting their cut with the composer.

The economics could be very different if you sold your music directly through iTunes. Apple keeps 35% of the money paid for a song, and passes along the other 65%. Performers don't get that cut today, of course – the record company takes it. The performers generally get 10-12% of revenue, about the same as what they get from a CD sold in a store. It's fascinating to me that the artists don't get a higher percentage of e-music revenue, even though electronic distribution eliminates the whole physical distribution chain, with its production expenses, shipping costs, retail overhead, and inventory challenges. This point has been made by some very angry websites.

Anyway, if you bypass the record company you can keep the whole 65% for yourself. This makes the preliminary calculation easy – it pays to bypass the record company when e-music accounts for more than about 16% of total unit sales of music. Even though you lose a ton of CD sales, you make up the loss because you're making so much more per online sale.

But it's not that simple, because unit sales on iTunes are 90% made up of 99-cent singles, whereas in a record store they are almost all $14 albums. I don't think this is just because people go to iTunes when they want to buy singles; I think iTunes turns people into singles buyers. So the economics gets very skunky for a current musical act. If you're selling through a record company today, you get about $2.10 per album sold (15% of $14). If you switch to iTunes, and 90% of your unit sales convert to singles, you'll get an average of about $1.23 per unit that you sell (65 cents per single plus $6.50 per album). You could actually lose money per unit by going to e-music, because you trade customers down from albums to singles. Presumably you'll sell more singles because they're cheaper, and because your fans might want more than one song from your album. But I don't know how big the uplift would be, and I seriously doubt it would overcome the reduced price per unit.

In this situation, it doesn't pay to go independent until e-music accounts for more than 63% of total music unit sales. Given the rate at which iTunes is growing, that could theoretically happen by the end of the decade – but counting on exponential growth to continue for several years is one of the dumbest things you can do in high tech. So the tipping point is probably even further off.

A new hope

The easiest way to bring the tipping point substantially closer is to charge more than 99 cents for an online single. For example, if you could sell your song online for $2.99, you would make more money selling on your own as soon as e-music sales reach about 47% of total music unit sales. Considering that e-music already has 25% unit share in the US, I think 47% might be achievable in the next two to three years.

It's ironic. The record companies have been campaigning loudly for the right to charge more than 99 cents per song, so they can make more money. But if they get their way, all they'll do is facilitate their own extinction.

Be very careful what you wish for.

I'm oversimplifying

The real situation is much more complex than what I've described above. You can make yourself nuts with the permutations. For example:

The effect of price changes is unpredictable. Changing the relative prices of singles and albums will alter the sales mix in ways no one can anticipate today. That might bring the tipping point closer, or push it further away. Also, if the price of online singles goes up too much, teenagers might go back to stealing music. Then the artists and the record companies would both starve, but the lawyers would get rich.

I assumed one single would substitute for one album. If people bought two e-music singles for every CD album that gets cannibalized, the threshold for the tipping point would be years closer. Does the average album has more than one best-selling song on it/ I'll let you judge.

The whole concept of singles and albums could melt away. An interesting essay in the Guardian pointed out that the single was constrained by the amount of music you can fit on a vinyl disk rotating 45 times a minute. The three-minute format is still useful for radio and music videos, but there's no reason that a downloaded song can't be 30 seconds long or twenty minutes long. The main limitation is our own assumptions.

Also, if a music group didn't have to focus on making albums, it might be able to spend more time crafting a smaller number of truly great songs. That would improve the overall quality of popular music, even if the total number of songs being written went down.

All the more reason for Apple to allow variable pricing.

Wireless sales to mobile phones are a wild card. The record companies are starting to get significant money from ringtones. (Supposedly revenue from them was 40% of total e-music revenue last year. The unit volume would be less than 40% because ringtones often cost more than 99 cents.) It's hard for an independent artist to sell ringtones because you have to go through mobile operator contracts, something that a big record company can negotiate much more easily. This might strengthen the record companies. On the other hand, as more phones develop MP3 ringtone capability, maybe more customers will start installing their own ringtones and bypass the operators. On the other other hand, maybe the operators will disable MP3 playback in the phones they sell. Good luck mapping out what'll happen here.

All of this is analysis is US-only. The development of the music market will probably be dramatically different in other countries, where PCs (and PC-based music downloading) are less popular, and people may be more interested in downloading music directly to a mobile phone. The wireless operators certainly hope that's what'll happen. The IFPI report on music sales in 2005 says that music downloading to PCs is dominant in the US, UK and Germany, while Italy, France, and Japan are strong in downloading to mobile phones (iTunes didn't even launch in Japan until June of 2005).

The impact of music subscription services is unclear. Then there are the subscription music companies like Real Networks' Rhapsody Unlimited and Yahoo's Music Unlimited. Steve Jobs has a funny quote about them: "I think you could make available the Second Coming in a subscription model and it might not be successful." I share some of his skepticism – to me, the idea of losing access to my music when I stop subscribing feels like blackmail. But on the other hand I know one of the senior guys in the music business at Real. He's wickedly smart, and I don't think he'd chase a useless idea. I haven't had a chance to do independent customer research on this subject, and it's possible that I'm just out of touch with how customers will behave, especially people younger than me.

The pricing structure for a music subscription service is completely different from a store like iTunes. To use Real's Rhapsody Unlimited for a year, you pay $120 and you can listen to all the music you want. If you want to keep listening to music, you have to pay again every year. Let's assume the case of a 20-year-old who lives until age 80. Over her lifetime, she'll pay $7,200 for music services.

That same investment in the iTunes music store would buy 7,272 singles, or one new song every three days for her entire life (for comparison, the average iTunes user today buys about three songs a month). For all but the most aggressive music users, a music subscription is a lot more expensive over your lifetime than buying songs – as long as you're thinking ahead 60 years. It's not clear that everyone does.

The situation gets more confusing when you look at the royalties for music used on subscription services. Believe it or not, no one knows what the royalties will be. The music industry and the subscription services have spent the last four years negotiating the issue, and they're still far apart. In the meantime, interim royalties are being paid into a holding fund; the musicians aren't being paid at all. The subscription companies want to pay 6.9% of their revenue in royalties, and the music companies want 14%. Even at that 14% figure, the lifetime royalty income from our 80-year-old-user would be only $1,008. The same user buying 7,272 singles on iTunes (even at just 99 cents a song) would produce royalties of about $4,700.

For music publishers and performers, selling songs is vastly more lucrative because they get a much bigger cut of the revenue. They have a strong incentive to see the subscription services fail.

No wonder the negotiations are so bitter. And no wonder Steve Jobs is so caustic toward the rental services – they get much higher margins than he does.

The negotiations may have to be decided by (brace yourself) the US Congress. There's no way to tell what Congress will do, and so there's no way today to tell if the subscription services will bring the tipping point closer or push it further away.

It's enough to make a person long for the "simple" days of vinyl records.

What will happen?

Anyone who tells you they know for sure what will happen to the music business is either delusional or selling something; the variables are too numerous and complex to make high-confidence predictions. But since I raised the subject here, I feel obligated to put a stake in the ground. So here's my guess:

Apple will eventually allow variable pricing on singles. That change has been slowed by New York state's investigation of the record companies for online song price-fixing. According to the LA Times, the focus of the investigation is on "most favored nation" clauses in which record company contracts mandated that they get the highest price for singles charged by any other record company. That would have the effect of jacking up prices automatically, the sort of thing the government frowns on. But the basic idea of a store charging more than 99 cents is apparently not at issue, and indeed some wireless music stores already do. So I believe that after holding out for another year or so to help solidify its dominance, Apple will eventually give in. The price of an online single will then settle at a balancing point that produces the most revenue without driving an explosion of piracy. I suspect (gut instinct here) that point is about $1.99 per song for current releases.

The move to variable pricing is essential to drive the economics of the tipping point, so I hope Apple will get on with it.

The tipping point will arrive in 2008 or 2009. Even if you can charge $2 a copy for an e-single, the financial case for an existing act to dump its record label and sell direct is difficult, because a current group needs to protect the revenue it gets from CD sales. But a newly-formed group doesn't have existing sales to protect, and it has the most to gain from the lower barriers to entry in online sales. I think the tipping point will come the first time a new music act, selling online, is able to make serious money from a hit single, without ever bothering to create an album, burn a CD, or sign with a record company. That example will incent a new generation of performers to bypass the record companies. Their critical mass of fresh talent will drive up e-music sales further, producing a self-reinforcing transition away from record industry control. Another gut guess: I think we'll hit the tipping point when you can sell a single on iTunes for $1.99, and when US e-music unit sales hit about a third of total music sales. If current growth continues (always a dangerous assumption), the tipping point could come in 2008. Call it 2009 if you want to be conservative.

When that day comes, I suspect that Steve Jobs will be there with a Mac-based music editing program that has a "publish" button in it. Press the button, and your song is automatically uploaded to iTunes.

Parts of the record industry that add value will survive indefinitely. Some people will continue to want CDs -- either for nostalgia or because, for the time being, CDs have higher sound quality. Even in the e-music space there will still be roles for business managers who discover new artists and help them market, producers who improve the quality of their music, and concert promoters.

The number of independent record stores will continue to decline. This has almost nothing to do with online music; it's being driven by competition from the mass retailers like Wal-Mart (the #1 US music chain in album sales), Target (#3), and Amazon (#4). They skim off the most popular titles and sell them for aggressive prices, gutting the margins of the record stores (the same thing is happening to independent toy stores). E-music will at most just accelerate this trend.

Can anyone stop the iPod?

No.

The time to stop it was two years ago. At this point the real question is whether anyone in the US can even keep up. The iPod is a system that includes both an online service and devices, and I think the only way to compete will be with full systems. Few companies with a presence in the US have both the skills and resources to do that. Microsoft can. Nokia can. Google and maybe Yahoo can. A stock analyst claimed in January that Google is planning a music store . Almost everyone in Silicon Valley would enjoy watching an Apple-Microsoft-Google cage match, but I think Google will be the first one hit in the head by a folding chair unless it also makes the devices.

Outside the US, the picture's much less clear. There aren't a lot of systems-oriented tech companies anywhere, but iTunes is much less established in many other countries, so there may still be time for smaller companies to make a play. In Japan, I would never bet against the two leading operators, NTT DoCoMo and KDDI.

The new powers in the industry will be the big online music stores. By featuring particular artists, they'll be able to make careers. Which e-music stores are likely to be dominant? In the US, Apple has a big lead in sales and an enormous lead in momentum. I dearly hope they won't be the single dominant store – if there's effective competition, it'll keep music prices low, give more of the rewards directly to artists, and make it easier for new acts to break into the industry. And that's the outcome that would make this whole complicated, painful transition worthwhile.

That's my take on things. What do you think? Do you have fixes to my analysis? Disagree with my conclusions? Please leave a comment – I'm interested in your perspective.

Next in Removing the Middleman: ebooks. And you thought music was complicated.

________________

*The music sales chart is based on figures from the RIAA (a music industry trade group), Rolling Stone, IFPI (another music industry trade group), and numbers extracted from a nifty historical chart prepared by Karl Hartig.

More info:

An organization called Future of Music Coalition has done a lot of analysis of music economics, from the perspective of an artist. I think it's very rational stuff, and a nice counterpoint to the strong rhetoric you hear from the tech companies on one side and the record companies on the other. I thought their analysis of iTunes was especially good. Highly recommended.

IFPI's report on global music downloads is interesting, even though it reads like it was written by a PR agency. It has some interesting tidbits on what's happening outside the US.

The Economist did a nice overview of the music industry.

There's a book and weblog called The Future of Music that talks about many of these issues. The authors have been in the music industry for years, and some of their conclusions are very different from mine. Check them out and you can make up your own mind. Also, I want to give them credit for pointing out the Rolling Stone quote that I used at the start of this post.

--Rolling Stone Magazine, January 13 2006

Most people agree that the Internet and technology changes will make it possible to replace the pipe companies – the carriers, publishers, and networks that deliver the world's information, entertainment, and communication. But that change has been predicted for years. Will it really happen? If so, when? And what business and technology infrastructure needs to be created first?

In Part One, I gave an overview of the situation. This time let's look in depth at the music industry. I'll start with a summary and then explain how I got there.

Summary: E-music changes the world in unexpected ways

--I think the biggest change happening in music distribution right now isn't piracy, it's cannibalization of CD albums by e-music singles.

--I can't believe I'm saying this, but despite all the hype, the iTunes music store is actually much more powerful than most people realize. I think it may already be too late for any competitor to stop iTunes from becoming the dominant music store in the US.

--The tipping point at which the record companies will become obsolete may arrive in about two years.

--The record companies think that variable pricing for an online single will increase their profits, but the main effect will actually be to bring the tipping point closer.

I thought this was going to be an easy post to write, but I was wrong. Every time I thought I was finished, I found major new pieces of information that forced me to go back and re-write. The situation's complicated enough that I'm still not sure I got everything right. So I'll be very interested in your comments. Before we talk about where the industry's going, we need to discuss where it is now...

The music industry today

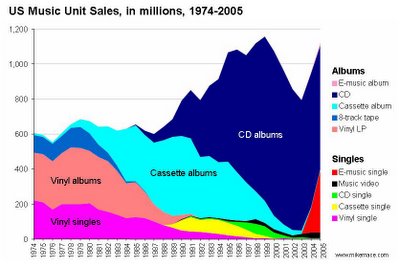

It's surprisingly hard to get clear data on what's happening in the music industry. Conditions are changing quickly, and the industry has some interesting counting practices that can easily confuse you unless you look at them very carefully. Below is the best chart I could create of music sales in the US (sorry, I couldn't find complete worldwide data). The chart shows US music unit sales by media type, from 1974 to 2005.*

Note that the chart shows unit sales, not revenue. Unit sales are a tricky thing in music – a single and an album each count as one unit. I used units because I couldn't find revenue numbers going back more than a few years. There are pluses and minuses to the units approach, which I'll discuss below.

The most striking thing you can see in the chart is the death and rebirth of the single. In 1974, singles were about a third of music unit sales, but by 2003 that share had dwindled to about 4%. That means music revenue grew much faster in the 1980s and 1990s than what you see in the chart, because customers moved from singles to more expensive albums.

Singles in a music store are a terrible buy today – a typical single on Amazon.com costs about $7-$10, and an album costs about $14. You might as well buy the album. And sure enough, most people do; about 97% of unit sales through retail are albums. The situation is reversed for e-music. On iTunes, a single costs 99 cents and an album costs about $10. Guess what, about 90% of iTunes unit sales are singles.

The big red triangle at the lower right-hand edge of the chart shows the impact of that online pricing structure. The triangle represents unit sales of e-music singles, primarily iTunes (Apple has about 70% to 83% of the US music download market, depending on which source you believe). iTunes and other online paid downloads raised the share of singles to about 25% of US unit sales in 2005, or about 353 million singles.

You can't see this in the chart, but revenue is not growing nearly as fast as units, because online singles are so much cheaper than CD albums. Rolling Stone even called 2005 the music industry's "worst ever." I guess they were thinking about musicians and record companies; music consumers had a fantastic year.

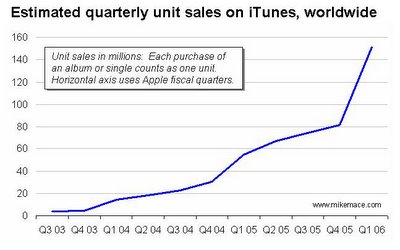

Are e-music sales still growing? A deeply pessimistic article by Bloomberg in November 2005 claimed that iTunes sales stopped growing in the summer of 2005. That drove a lot of pessimistic discussion in music industry circles, and let to a lot of criticism of Apple. If e-music has stopped growing, that would have very enormous implications for the industry, so I tried to figure out what's really happening.

Apple doesn't give clear, regular reports on iTunes music sales. It occasionally issues a press release when it hits a milestone (100m songs sold, etc), and in its quarterly financials it reports a revenue figure for the iTunes store. But that number includes revenue from sales of iPod accessories, which are pretty large. You have to find a way to remove the accessory numbers. Here's what how I did that:

In Apple's fiscal first quarter of 2006 (the three months ending December 2005), it reported iTunes revenue of $491 million. Steve Jobs said at Macworld that the company was selling three million songs a day. That would produce revenue of about $273 million. So the iTunes revenue figure that Apple reports is about 56% songs and 44% accessories.

I went to Apple's previous financial reports, extracted the iTunes revenue numbers, and applied the 56% figure to them. The resulting estimate of iTunes unit sales matched up nicely with Apple's press releases on song sales, so I'm confident that the chart you see below is roughly accurate:

As you can see, Bloomberg was spectacularly wrong -- iTunes unit sales continue to grow quickly. Why did Bloomberg get it wrong? I suspect they made the mistake of looking at quarter to quarter numbers during the summer, when consumer electronics sales almost always stagnate. Sales then explode over the Christmas period. In consumer electronics, you always have to look at year over year comparisons, not quarter to quarter.

iTunes: The Creature that Ate Motown. Setting aside the growth rate, the raw numbers themselves are pretty astounding to me. iTunes alone probably accounts for about one in every five music purchases in the United States right now, and it's continuing to grow.

I think the impact of iTunes has been understated by analysts and the press. In November of 2005, NPD issued a report saying that iTunes had jumped into the top ten US music resellers, at number seven (above Tower Records and below Circuit City). But to calculate its figures, NPD divided iTunes' unit sales by 12, to account for the fact that most iTunes sales are singles. That's appropriate if you're looking at revenue, but I think the total number of transactions is still very meaningful – it speaks to the general amount of business you're driving, and the number of people you're touching.

Think about it: if NPD had counted transactions, iTunes would have tied with Wal-Mart (20% of US music sales) as the largest music store in the United States. Considering its current growth rate, iTunes is certain to become the largest unit seller of music in the US in 2006.

People talk about iTunes as if it's an early stage business, and they discuss all the rival e-music stores as if they're all on the same level as Apple. I'm starting to think that the real question is whether iTunes has already reached a position of unassailable dominance in e-music. I don't know if anyone else in the US can develop enough momentum fast enough to overcome what Apple's doing.

There are hints that Microsoft might try, though. A recent BusinessWeek article reports that Microsoft is considering building an iPod competitor, although the hints in the article make it sound more like a PSP wannabe. Microsoft has enough financial muscle to challenge Apple, but I don't know if it has the system design skills. Maybe it knows enough, though -- all it has to do is imitate Apple, and Microsoft certainly knows how to do that...

Why did CD sales drop after 2000? There's another important point to notice in the chart. Check out the decline in total music unit sales from 2000 to 2003. This is what has the music industry so concerned about Internet piracy, which some people assume is the cause of the decline. Because albums cost more than singles, the decline actually had a larger impact on industry revenue than the chart shows. Personally, I'm sure file sharing is part of the cause. But there are a lot of other explanations as well:

--The Economist claims an internal study conducted by one of the major record companies found that only 1/3 of the drop was attributable to online piracy, with much of the blame instead going to piracy of CDs and especially to the failure of the music companies to promote interesting new music.

--A study by professors at Harvard and the University of North Carolina could find no correlation between online music downloads and reduced sales of CDs. Other studies did find a correlation. This is one of those cases where you can pick the data that matches your preconceptions.

--Some interesting charts here and here argue that the economic downturn in 2001 and rising album prices may have been at fault. The author also points out that record companies dramatically cut their new music releases in the years that sales declined. I'm not sure whether that was a cause or an effect of the sales drop, but at minimum it probably steepened the decline.

--Even some record industry execs say the decline is due in part to rising competition from other forms of entertainment, like DVDs and video games.

Whatever the cause of the album sales slowdown in the past, I think what's happening today is crystal clear: Online singles are replacing CD albums. Unless you're dying to get a full album or you're a stickler for sound quality, there's a huge financial penalty for buying music on a CD today. As that fact sinks into the minds of consumers, music downloads are almost certain to continue to grow.

Welcome to the rabbit hole, Alice

That was the straightforward part of the post. Now things get tricky. Even with the growth of e-music, the record companies are still in charge today. Most musicians are still selling through music publishers whe keep most of the revenue; the artists and record companies are just splitting a smaller pie. I wanted to calculate the tipping point, the point at which it's more profitable for a musician to sell directly through iTunes and other online stores rather than going through a record company. Bear with me while a poli sci major tries to do math...

First, let's look at the economics of music today. If you record a hit song, you'll get less than 15% of the money that people pay to buy it. Maybe you'll get less than 2%. The New York Daily News did a nice case study of what happens to the money when a group creates an album that goes gold. Their fictional rock group, Grunthead, produces a record that brings in $8.49 million. The record company and distribution channels take about 85% of that off the top, and give 15% to the group. But then there are additional charges to produce the album, plus legal and agent fees. These reduce the band members' income to just $161,909 – 1.9% of revenue.

By the way, this assumes the band wrote all its own songs. If the songs were composed by someone else, the musicians would end up roughly splitting their cut with the composer.

The economics could be very different if you sold your music directly through iTunes. Apple keeps 35% of the money paid for a song, and passes along the other 65%. Performers don't get that cut today, of course – the record company takes it. The performers generally get 10-12% of revenue, about the same as what they get from a CD sold in a store. It's fascinating to me that the artists don't get a higher percentage of e-music revenue, even though electronic distribution eliminates the whole physical distribution chain, with its production expenses, shipping costs, retail overhead, and inventory challenges. This point has been made by some very angry websites.

Anyway, if you bypass the record company you can keep the whole 65% for yourself. This makes the preliminary calculation easy – it pays to bypass the record company when e-music accounts for more than about 16% of total unit sales of music. Even though you lose a ton of CD sales, you make up the loss because you're making so much more per online sale.

But it's not that simple, because unit sales on iTunes are 90% made up of 99-cent singles, whereas in a record store they are almost all $14 albums. I don't think this is just because people go to iTunes when they want to buy singles; I think iTunes turns people into singles buyers. So the economics gets very skunky for a current musical act. If you're selling through a record company today, you get about $2.10 per album sold (15% of $14). If you switch to iTunes, and 90% of your unit sales convert to singles, you'll get an average of about $1.23 per unit that you sell (65 cents per single plus $6.50 per album). You could actually lose money per unit by going to e-music, because you trade customers down from albums to singles. Presumably you'll sell more singles because they're cheaper, and because your fans might want more than one song from your album. But I don't know how big the uplift would be, and I seriously doubt it would overcome the reduced price per unit.

In this situation, it doesn't pay to go independent until e-music accounts for more than 63% of total music unit sales. Given the rate at which iTunes is growing, that could theoretically happen by the end of the decade – but counting on exponential growth to continue for several years is one of the dumbest things you can do in high tech. So the tipping point is probably even further off.

A new hope

The easiest way to bring the tipping point substantially closer is to charge more than 99 cents for an online single. For example, if you could sell your song online for $2.99, you would make more money selling on your own as soon as e-music sales reach about 47% of total music unit sales. Considering that e-music already has 25% unit share in the US, I think 47% might be achievable in the next two to three years.

It's ironic. The record companies have been campaigning loudly for the right to charge more than 99 cents per song, so they can make more money. But if they get their way, all they'll do is facilitate their own extinction.

Be very careful what you wish for.

I'm oversimplifying

The real situation is much more complex than what I've described above. You can make yourself nuts with the permutations. For example:

The effect of price changes is unpredictable. Changing the relative prices of singles and albums will alter the sales mix in ways no one can anticipate today. That might bring the tipping point closer, or push it further away. Also, if the price of online singles goes up too much, teenagers might go back to stealing music. Then the artists and the record companies would both starve, but the lawyers would get rich.

I assumed one single would substitute for one album. If people bought two e-music singles for every CD album that gets cannibalized, the threshold for the tipping point would be years closer. Does the average album has more than one best-selling song on it/ I'll let you judge.

The whole concept of singles and albums could melt away. An interesting essay in the Guardian pointed out that the single was constrained by the amount of music you can fit on a vinyl disk rotating 45 times a minute. The three-minute format is still useful for radio and music videos, but there's no reason that a downloaded song can't be 30 seconds long or twenty minutes long. The main limitation is our own assumptions.

Also, if a music group didn't have to focus on making albums, it might be able to spend more time crafting a smaller number of truly great songs. That would improve the overall quality of popular music, even if the total number of songs being written went down.

All the more reason for Apple to allow variable pricing.

Wireless sales to mobile phones are a wild card. The record companies are starting to get significant money from ringtones. (Supposedly revenue from them was 40% of total e-music revenue last year. The unit volume would be less than 40% because ringtones often cost more than 99 cents.) It's hard for an independent artist to sell ringtones because you have to go through mobile operator contracts, something that a big record company can negotiate much more easily. This might strengthen the record companies. On the other hand, as more phones develop MP3 ringtone capability, maybe more customers will start installing their own ringtones and bypass the operators. On the other other hand, maybe the operators will disable MP3 playback in the phones they sell. Good luck mapping out what'll happen here.

All of this is analysis is US-only. The development of the music market will probably be dramatically different in other countries, where PCs (and PC-based music downloading) are less popular, and people may be more interested in downloading music directly to a mobile phone. The wireless operators certainly hope that's what'll happen. The IFPI report on music sales in 2005 says that music downloading to PCs is dominant in the US, UK and Germany, while Italy, France, and Japan are strong in downloading to mobile phones (iTunes didn't even launch in Japan until June of 2005).

The impact of music subscription services is unclear. Then there are the subscription music companies like Real Networks' Rhapsody Unlimited and Yahoo's Music Unlimited. Steve Jobs has a funny quote about them: "I think you could make available the Second Coming in a subscription model and it might not be successful." I share some of his skepticism – to me, the idea of losing access to my music when I stop subscribing feels like blackmail. But on the other hand I know one of the senior guys in the music business at Real. He's wickedly smart, and I don't think he'd chase a useless idea. I haven't had a chance to do independent customer research on this subject, and it's possible that I'm just out of touch with how customers will behave, especially people younger than me.

The pricing structure for a music subscription service is completely different from a store like iTunes. To use Real's Rhapsody Unlimited for a year, you pay $120 and you can listen to all the music you want. If you want to keep listening to music, you have to pay again every year. Let's assume the case of a 20-year-old who lives until age 80. Over her lifetime, she'll pay $7,200 for music services.

That same investment in the iTunes music store would buy 7,272 singles, or one new song every three days for her entire life (for comparison, the average iTunes user today buys about three songs a month). For all but the most aggressive music users, a music subscription is a lot more expensive over your lifetime than buying songs – as long as you're thinking ahead 60 years. It's not clear that everyone does.

The situation gets more confusing when you look at the royalties for music used on subscription services. Believe it or not, no one knows what the royalties will be. The music industry and the subscription services have spent the last four years negotiating the issue, and they're still far apart. In the meantime, interim royalties are being paid into a holding fund; the musicians aren't being paid at all. The subscription companies want to pay 6.9% of their revenue in royalties, and the music companies want 14%. Even at that 14% figure, the lifetime royalty income from our 80-year-old-user would be only $1,008. The same user buying 7,272 singles on iTunes (even at just 99 cents a song) would produce royalties of about $4,700.

For music publishers and performers, selling songs is vastly more lucrative because they get a much bigger cut of the revenue. They have a strong incentive to see the subscription services fail.

No wonder the negotiations are so bitter. And no wonder Steve Jobs is so caustic toward the rental services – they get much higher margins than he does.

The negotiations may have to be decided by (brace yourself) the US Congress. There's no way to tell what Congress will do, and so there's no way today to tell if the subscription services will bring the tipping point closer or push it further away.

It's enough to make a person long for the "simple" days of vinyl records.

What will happen?

Anyone who tells you they know for sure what will happen to the music business is either delusional or selling something; the variables are too numerous and complex to make high-confidence predictions. But since I raised the subject here, I feel obligated to put a stake in the ground. So here's my guess:

Apple will eventually allow variable pricing on singles. That change has been slowed by New York state's investigation of the record companies for online song price-fixing. According to the LA Times, the focus of the investigation is on "most favored nation" clauses in which record company contracts mandated that they get the highest price for singles charged by any other record company. That would have the effect of jacking up prices automatically, the sort of thing the government frowns on. But the basic idea of a store charging more than 99 cents is apparently not at issue, and indeed some wireless music stores already do. So I believe that after holding out for another year or so to help solidify its dominance, Apple will eventually give in. The price of an online single will then settle at a balancing point that produces the most revenue without driving an explosion of piracy. I suspect (gut instinct here) that point is about $1.99 per song for current releases.

The move to variable pricing is essential to drive the economics of the tipping point, so I hope Apple will get on with it.

The tipping point will arrive in 2008 or 2009. Even if you can charge $2 a copy for an e-single, the financial case for an existing act to dump its record label and sell direct is difficult, because a current group needs to protect the revenue it gets from CD sales. But a newly-formed group doesn't have existing sales to protect, and it has the most to gain from the lower barriers to entry in online sales. I think the tipping point will come the first time a new music act, selling online, is able to make serious money from a hit single, without ever bothering to create an album, burn a CD, or sign with a record company. That example will incent a new generation of performers to bypass the record companies. Their critical mass of fresh talent will drive up e-music sales further, producing a self-reinforcing transition away from record industry control. Another gut guess: I think we'll hit the tipping point when you can sell a single on iTunes for $1.99, and when US e-music unit sales hit about a third of total music sales. If current growth continues (always a dangerous assumption), the tipping point could come in 2008. Call it 2009 if you want to be conservative.

When that day comes, I suspect that Steve Jobs will be there with a Mac-based music editing program that has a "publish" button in it. Press the button, and your song is automatically uploaded to iTunes.

Parts of the record industry that add value will survive indefinitely. Some people will continue to want CDs -- either for nostalgia or because, for the time being, CDs have higher sound quality. Even in the e-music space there will still be roles for business managers who discover new artists and help them market, producers who improve the quality of their music, and concert promoters.

The number of independent record stores will continue to decline. This has almost nothing to do with online music; it's being driven by competition from the mass retailers like Wal-Mart (the #1 US music chain in album sales), Target (#3), and Amazon (#4). They skim off the most popular titles and sell them for aggressive prices, gutting the margins of the record stores (the same thing is happening to independent toy stores). E-music will at most just accelerate this trend.

Can anyone stop the iPod?

No.

The time to stop it was two years ago. At this point the real question is whether anyone in the US can even keep up. The iPod is a system that includes both an online service and devices, and I think the only way to compete will be with full systems. Few companies with a presence in the US have both the skills and resources to do that. Microsoft can. Nokia can. Google and maybe Yahoo can. A stock analyst claimed in January that Google is planning a music store . Almost everyone in Silicon Valley would enjoy watching an Apple-Microsoft-Google cage match, but I think Google will be the first one hit in the head by a folding chair unless it also makes the devices.

Outside the US, the picture's much less clear. There aren't a lot of systems-oriented tech companies anywhere, but iTunes is much less established in many other countries, so there may still be time for smaller companies to make a play. In Japan, I would never bet against the two leading operators, NTT DoCoMo and KDDI.

The new powers in the industry will be the big online music stores. By featuring particular artists, they'll be able to make careers. Which e-music stores are likely to be dominant? In the US, Apple has a big lead in sales and an enormous lead in momentum. I dearly hope they won't be the single dominant store – if there's effective competition, it'll keep music prices low, give more of the rewards directly to artists, and make it easier for new acts to break into the industry. And that's the outcome that would make this whole complicated, painful transition worthwhile.

That's my take on things. What do you think? Do you have fixes to my analysis? Disagree with my conclusions? Please leave a comment – I'm interested in your perspective.

Next in Removing the Middleman: ebooks. And you thought music was complicated.

________________

*The music sales chart is based on figures from the RIAA (a music industry trade group), Rolling Stone, IFPI (another music industry trade group), and numbers extracted from a nifty historical chart prepared by Karl Hartig.

More info:

An organization called Future of Music Coalition has done a lot of analysis of music economics, from the perspective of an artist. I think it's very rational stuff, and a nice counterpoint to the strong rhetoric you hear from the tech companies on one side and the record companies on the other. I thought their analysis of iTunes was especially good. Highly recommended.

IFPI's report on global music downloads is interesting, even though it reads like it was written by a PR agency. It has some interesting tidbits on what's happening outside the US.

The Economist did a nice overview of the music industry.

There's a book and weblog called The Future of Music that talks about many of these issues. The authors have been in the music industry for years, and some of their conclusions are very different from mine. Check them out and you can make up your own mind. Also, I want to give them credit for pointing out the Rolling Stone quote that I used at the start of this post.